Rules

I violated two of my trading rules this morning, and paid for it.

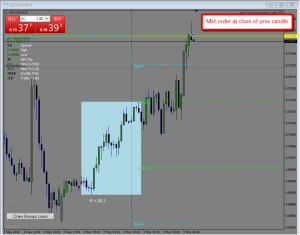

I came to the charts early, about 5:15 CDT, just to look them over and make sure they were set up for the day. I observed a strong uptrend in NZDUSD, with a slight pullback:

So I took the trade. And, over the next hour, the pullback continued, and stopped me out for a <10.0> pip loss.

The two rules I violated were these:

- Never take a trade before you have completed the trade plan for all pairs.

- Don’t trust London session clear moves in last few hours before NYC open, because the have a tendency to devolve into sideways chop.

So, I’m starting the day down 10 pips, and we’ll see what it brings. We have CAD news (Trade Balance) at 7:30, and USD news (ISM Non-Manufacturing PMI) at 9:00.

Having completed the trade planning, I see most of the USD pairs are in ranges, while most of the YEN crosses are in clear directional moves to the downside (indicating Yen strength).

Entered EURJPY short on a pulback. Considering GBPJPY short on a similar pullback, but I’m cautious about overweighting in the Yens.

Went ahead and took the GBPJPY when it rose 3 pips above the YL, and then started to pullback slightly. Now setting up for the CAD news at 7:30.

Took a long on USDCAD on the news after it surged, then stabilized, and pulled back. Took it expecting it to continue higher, but it continued to pull back and stop me out for <10.2>

Meanwhile, EURJPY stopped out for <10.2>, and a pending order for a break out on the AUDJPY was triggered (short). That was within the 2-minute period, and should have been pulled, but I was focusing on the CAD news. At the moment, it’s pulling back up into the range, but we’ll see.

Not a good beginning to the morning. And the AUDJPY continued to pull back and stopped out for <12.1>. Currently down<42.5>, and holding GBPJPY. Getting closer to market open, and set up some pending trades on range breaks, as well as a few YL pendings. (USDJPY).

Entered USDJPY short on a pullback. The pullback also caused the GBPJPY, which had been up as much as 15 pips, to pullback. It’s now up 6 pips. And the USDJPY pullback continued and is down < 5>.

Entered AUDUSD long on a pullback, and CADJPY short on a pullback.

Currently (8:21) still down <42.5>, and holding GBPJPY, USDJPY, AUDUSD, and CADJPY. Unfortunatly, the Yen strength appears to be waning for the moment, resulting in the Yen crosses rising. But that could be short-lived. #weneverknow. Coming up on NY market open.

CADJPY stopped out after 2 candles for <12.2>. Now down <56.7>. Canceled all my pending orders – the 3 trades I have open are not looking good, and if they were all to stop out, I’d be down <88>.

Kim just punched out for AUDUSD for <7> “to free up margin”. I don’t need to free up margin (since I have no pending trades), but should I consider doing the same. It’s not looking good. I need the USD to fall (which will help the USDJPY and AUDUSD trades), and the Yen to strengthen. Wishful thinking, unfortunately, doesn’t help.

I went ahead and punched out of AUDUSD for <6.1> when I noticed that AUDJPY was moving down pretty sharply, likely taking AUDUSD with it regardless of the USD strength or weakness. That leaves me with GBPJPY and USDJPY, both of which have improved somewhat. May go ahead and reinstate some of the pendings I canceled.

Range break pendings and pending for re-entry on continuation have been re-set. Not looking for any YL’s right now.

And GBPJPY has gone from up 8 (on this run) back to negatve. USDJPY has also gone from just barely positive to <3>

Coming up on USD Non-Manufacturing PMI news. See if that helps us. It may take out the USDJPY trade, but I’d be down anyway if I closed it now.

Punched out of GBPJPY on a burst for +16.8. Reduces my losses to <44.0>.

Triggered a pending on a GBPUSD range break short. But the candle closed back inside the range, and punched out for <7.2> Now down <51.2>

Pending order for re-entry on EURJPY triggered at 130.798. Has run up about 13 pips, but now pulled back. Have moved to lock in BE.

There was a flurry of activity that I have to catch up. Yens moved. Re-entries hit on AUDJPY and CADJPY. EURJPY hit take profit at the ’50 level for +29.8. USDJPY hit TP for +10. Punched out of AUDJPY for +9.0 and CADJPY for +14.3. Range break pending hit on USDCAD long, currently up about 5. It’s been flirting with the ’00 level, which would be up 11, and has pulled my trailing stop up to BE.

And now a re-entry trade on GBPUSD after the previous CBIR has triggered, and I’m in that short at 1.3550. Currently (9:52) up +12.2. A ways to go if I’m looking for 65, but not out of the question.

USDCAD hit the trailing protective stop for +1.6. Probably poor trade management after it was up about 15.

Now up 13.8 and still holding GBPUSD, which has pulled back from being up about 7 to somewhere around BE. Still looking for something around +50 to close out the week. Heading into London close. We’ll see…

Set 3 pending orders for YL pullbacks on AUDJPY, USDJPY, and CADJPY. I’ll see if any of them hit. Kim just tweeted “The #YENS do not look quite done yet… just sayin'”. We’ll see.

And added EURJPY and GBPJPY pending orders. But the yens have already moved down and away from my orders, so it’s doubtful they will hit. But the GBPUSD has turned positive again. I need about 10 more pips to be at 50 for the week, and about 35 to hit my target of +75.

GBPUSD stopped out, and the Yen crosses suddenly surged upward. I managed to pull my pendings, and I’m trying one market order on GBPJPY entered when (I hope) price had stalled in it push upward.

The GBPJPY candle just became a change over. Doesn’t look good. It’s currently down <7.9>.

Going for broke. Just took the EURJPY entry as well. If it all goes bad, I’m not down that much, and if it goes even a little bit good it ups my chances or reaching my goal. Plus, if the GBPJPY stops out, the EURJPY might survive.

And it happened – GBPJPY stopped out for <12.1>. That puts me down <8.4> for the day, and still holding EURJPY, which is also in trouble.

Canceling all pendings. This will be the last trade for the day. And it just stopped out for <10.1>.

Summary: 16 trades, 6 wins for 81.8 pips, but 10 losses or <100.4> pips. Net <18.6> (-0.93%). +8.1 for the week.

I might trade NFP tomorrow to try to make it up.